The Ultimate Guide To Using Credit Cards, Debit Cards & ATMs in Europe

Using credit cards, debit cards, and ATMs in Europe has actually gotten a lot simpler, more user-friendly, and safer over the last few years—but there are still a few quirks you should know about so you don’t run into any trouble. In this guide, I’ll cover everything you need to know about using money in Europe so you can avoid fraud and excess fees, as well as ways to ensure you always have access to money.

Visa And Mastercard The Most Widely Accepted Credit Cards

Visa and Mastercard are both accepted nearly everywhere in Europe that takes credit cards.

American Express is accepted at higher-end businesses but you’ll still find quite a few places that won’t accept Amex, so it shouldn’t be your primary card.

Discover is not widely accepted in Europe so it shouldn’t be your primary card.

Make sure your debit and credit cards have the Cirrus or Plus logo on them—nearly every Visa or MasterCard has one. Cards with these logos will largely work anywhere in Europe.

Bottom line: Use either Visa or Mastercard when traveling in Europe.

Contactless Payment vs. Chip-and-PIN vs. Swipe & Sign Cards

Contactless card payments have become the standard in Europe so retail employees will default to presenting you with this option.

Chip-and-PIN cards are also widely accepted so at a bare minimum you want a Chip and PIN card (so you’ll also need to know your PIN code).

Paying by swiping your credit card and signing the receipt isn’t done in Europe (only US still does this). Some credit card terminals can still take swipe cards but many of the newer ones aren’t designed to accept them.

Using Your Smartphone (Apple Pay & Google Pay) Is The Safest Way To Make Purchases in Europe

The absolute safest way to pay for things in Europe is via your smartphone with Apple Pay or Google Pay.

This is because Apple Pay and Google Pay encrypt all your data so there is no way for scammers to steal/intercept your card details when you make purchases. In fact, your card details are never actually stored on your phone—instead, a unique one-time-use encrypted code is created for each transaction and that code (not your account number) is transmitted to authorize the transaction.

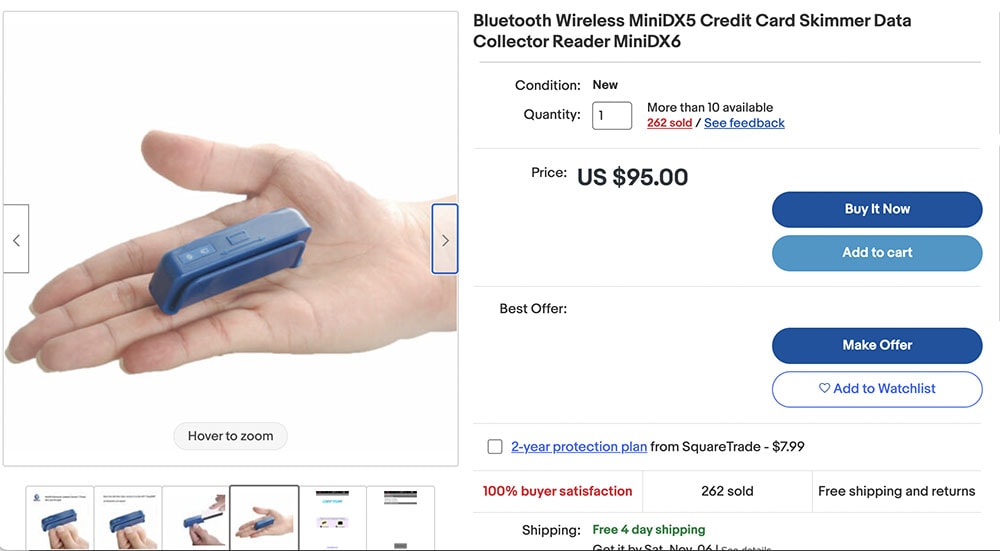

Physical credit cards and debit cards can be easily skimmed (i.e. copied) because the information stored on the card’s magnetic strip isn’t encrypted and can thus be instantly copied with a card reader.

Furthermore, physical cards have a built-in chip that transmits the cards’ information wirelessly and these can be read with a simple scanner that wirelessly scans the victim’s payment card. That’s why you should keep your cards in RFID-blocking wallets, purses, sleeves, etc.

Plus, you can set up two-factor identification for all mobile transactions (fingerprint, face ID, passcodes, etc.) to add another level of protection.

You can also load your debit and ATM card onto your phone so you can use your phone to withdraw cash from most ATMs (a majority of European ATMs are also contactless).

As an added bonus, on my latest trip, I had fraudulent charges on my debit card so my bank canceled my debit card and mailed me a new card to my home address. But, they were able to automatically update my debit card in my Apple Wallet so I could still withdraw cash at the ATM with my debit card via my iPhone/Apple Pay. The entire process took about an hour and I didn’t have to do anything.

Is Apple Pay & Google Pay Widely Accepted In Europe?

Yes, a very large percentage of retailers of all sizes throughout Europe have converted to contactless payments so any of these retailers should be able to accept both Apple Pay and Google Pay.

According to Visa, over 90% of in-store Visa payments in Europe are now contactless.

On my recent trip to France, I think I used Apple Pay 99% of the time—even for small purchases.

Even many automated machines like metro/train ticket kiosks and vending machines accept contactless payment.

Of course, there are still some businesses that still only accept cash and a minority might have a minimum purchase for credit card purchases.

That said, always have a physical card on hand to be safe.

FUN FACT: You do not need any type of internet connection to use Apple/Google Pay because they use NFC chip (Near Field Communications) to transfer the payment information to the store’s terminal—which requires no internet connection.

Only Use Debts Cards at ATMs and Only Use Credit Cards to Make Purchases

Never use physical DEBIT cards to pay for things. Only use your DEBIT card (or Apple/Google Pay) to withdraw money from ATMs — that’s it.

And only use CREDIT cards (or cash or Apple/Google Pay) to pay for things when you travel.

But why?

Because European tourist hotspots have a huge problem with card skimming (i.e. waiters and shopkeepers use card readers to make instant copies of your cards). But you also have to be careful about using an ATM because thieves can install hidden skimmers on the ATM which will copy the card details of anyone who uses it.

Your debit card is directly tied to your bank account so scammers can drain your checking account very quickly. Furthermore, it’s much harder to recover this money and it can take days or weeks to get worked out with your bank.

Your bank will then cancel your debit card if they see fraudulent purchases — which means you’ll have no access to cash because you won’t be able to use your card to withdraw money from the ATM.

However, if your credit card is compromised you’ll still be able to get cash via your debit card/ATM. Plus, credit card companies won’t hold you liable for fraud.

Avoid Credit Cards With Foreign Transaction Fees

Many credit cards charge a foreign transaction fee of anywhere from around 2%-3% of each transaction — which can quickly add up.

There are a number of credit cards that don’t charge any foreign transaction fees so that’s something to look into.

However, some of these cards charge an annual fee which might offset the benefit of not charging foreign transaction fees so search for a card that doesn’t charge an annual fee as well.

Avoid Paying Excessive Foreign ATM Fees

Unless your bank gives you free ATM withdrawals, you should be aware that your bank will charge you a fee for withdrawing cash in Europe.

Luckily, most European ATMs don’t charge a fee on their end but your home bank probably will.

Expect your bank to charge you between $2-$5 per withdrawal—which can really add up if you make multiple small withdraws. That’s why I recommend taking out larger chunks of cash so you pay fewer fees. Personally, I usually withdraw around $100-$150 at a time and try to avoid using cash until the last part of my trip so I don’t have to withdraw cash as much.

Furthermore, don’t be shy about asking your bank to refund one or two of these foreign ATM transaction fees as most will often do it. Learn more about Foreign ATM fees.

Keep Your Cards Separate & Have A Backup Credit Card

I always travel with a backup credit card just in case something does happen and my bank cancels my primary card because of theft or fraudulent purchases.

I keep this card separate from my other cards so if my wallet gets stolen I’ll still have access to money.

Call Your Bank Before Traveling

I was surprised that many banks these days don’t require you to call them ahead of time to let them know that you plan on using your card while traveling to Europe — I guess their algorithms are getting so good that they can better spot fraudulent purchases. Personally, both Chase and my Apple Card said I didn’t need to let them know.

But it’s still worth looking into just to be safe.

ATM Tricks and Scams

The best way to get cash is via the ATM and luckily they’re everywhere in Europe. But there are a few things you need to know that will help save you money.

Use ATMs From Large Banks

First, only use ATMs from large banks (HSBC, BNP Paribas, Crédit Agricole, Banco Santander, Barclays, Deutsche Bank, etc.) since these banks are much less likely to pull scammy tricks. Typically, these banks will give you the current change rate and they don’t charge you a fee to use their ATMs.

For extra security, use the ATM inside the bank during business hours because the machines are less likely to be tampered with and you’re less likely to be targeted by pickpockets.

Avoid Euronet, Eurobank, Alpha Bank Other Private ATM Networks

There are a few private ATM networks like Euronet, Eurobank, and Alpha Bank that aren’t connected to large banks. These ATMs are notorious for doing sketchy things like charging withdrawal fees and tricking you into accepting a terrible exchange rate.

In fact, once you add up all these fees, it’s not uncommon that you’ll pay 15%-30% in fees.

These ATMs are all over the place and they’re most often found in airports, train stations, and tourist hotspots to target people who don’t know any better.

Typically these ATMs are freestanding units so that’s an easy way to tell they’re not connected to a large bank.

Never Choose “Accept Conversion” When Withdrawing Money

Some ATMs (notably Euronet and the like) will ask if you want to convert the withdrawal to your home currency. This is a scam that gives you a terrible exchange rate and you’ll typically pay about 10%-15% extra for no reason. Always DECLINE CONVERSION and you’ll be charged the current exchange rate.

Beware Of Excessive Withdraw Amounts

Some ATMs will default to giving you large amounts of cash so you’ll have to search for the option to withdraw a lower amount. For example, the ATM might default to €200, €300, €500, €800, and €1000 as your withdrawal options so you’ll have to tap around to get a lower amount.

This is most common in countries that don’t use Euros or Pounds since the currencies are much more unfamiliar to visitors. For example, $100 equals 31,168.915 Hungarian Forints so it’s hard to do the conversion in your head when you see such large numbers. You might go to the ATM in Hungry and it asks if you want to withdraw 150,000 Hungarian Forints and you’d probably have no idea how much that would be in your home currency.

Why do some ATMs do this?

Currency conversion fees (see the previous point).

These ATMs know some users will “Accept Conversion” when they withdraw cash and that means the ATM company will pocket around 15% in fees.

Tampered ATMs

Thieves and scammers tampering with ATMs have been a problem for a long time.

Typical scams include installing external card skimmers to card input slot that copies card, installing hidden cameras to record PIN codes, and sometimes it’s just pickpockets waiting to grab your cash when you’re not looking.

So poke around the ATM before using it and move along if something doesn’t seem right.

Do You Need To Get Euros, Pounds, Etc. In The US Before Traveling?

You most likely don’t need to get any foreign currency from your home bank before traveling to Europe because any international airport will have ATMs where you can withdraw cash.

If you really want to play it safe, buy around $100 worth of Euros, Pounds, etc. just in case there is some fluke problem with the ATMs and your credit cards don’t work when you arrive.

But you certainly don’t want to buy a large amount of foreign currency with you because your home bank will charge you a terrible exchange rate + other fees and having a bunch of cash isn’t very safe.

No Funny Business

The Savvy Backpacker is reader-supported. That means when you buy products/services through links on the site, I may earn an affiliate commission—it doesn’t cost you anything extra and it helps support the site.

Thanks For Reading! — James

Questions? Learn more about our Strict Advertising Policy and How To Support Us.